Danny Varona, Jay Kipp, and Realogics Sotheby’s International Realty proudly present this in-depth exploration of the floating home real estate market. With demand reaching record levels amidst an unprecedented number of sales, this past year has been a busy one. In this report, we follow the trends that are likely to shape the floating home market in 2022. Our data, insights, and reflections on recent market trends are a must-read for floating home owners, sellers, and buyers.

Overview

2021 marked another excellent year for the floating home market in Seattle. A record number of floating homes (39) sold in 2021, beating last year’s record of 33 sales, and twice the number of sales when compared to 2019 when only 20 floating homes changed hands*.

The unprecedented uptick in sales activity is in line with The Great Reshuffling we are noticing nationwide as a direct result of the Pandemic. Flexible work-from-home policies, social isolation, and travel restrictions among other factors have made “home” more important than ever and many are on the move to find the right fit.

Despite the record number of floating homes offered for sale, inventory levels remained low throughout the year thanks to the most robust buyer demand we have seen in recent history.

In fact, competition for floating homes in 2021 was fierce with 34% of floating homes selling over the asking price due to bidding wars. The average price escalation as a result of bidding wars was 16%. This is in stark comparison to 2020 when only 8% of floating homes for sale enjoyed a bidding war, and the average escalated price was just 8%.

Moreover, floating homes are selling significantly faster every year. In 2021, floating homes sold in just 12 days (median), compared to 24 days in 2020, and 53 days in 2019. In other words, every year it takes half the time to sell a floating home compared to the previous year.

While many floating homes sold after just a few weeks on the market, some sat on the market between 112 and 184 days or failed to sell despite very favorable market conditions. The most effective way to avoid languishing on the market is to work with a floating home expert who will help you skillfully prepare, strategically price, and aggressively market your home.

* There are 4 types of “houseboats” in Seattle. This analysis is exclusive to Floating Homes and it does not include the other 3 types (Floating on Water Residences (FOWRs), Registered Barges, and Vessels with Dwelling Units (VDU)). See this blog post to learn more about the difference between the 4 types of houseboats in Seattle.

One way our buyers are outbidding other competing buyers is by making cash offers which favors sellers due to a shorter period to close, no appraisals, and less hiccups compared to financed offers. In fact, our analysis revealed that cash transactions have been increasing over the past 3 years. In 2021, 37% of floating homes sold with a cash offer, compared to 33% in 2020, and 30% in 2019. A bidding war, however, is not always won by the highest cash offer. The typical floating home sale has over 10 negotiable terms aside from the price and the type of financing, which can sway the outcome of the bidding process to a buyer’s favor even when they are not the highest bidder. Our goal as listing agents is to work with the buyers’ agents to help them craft the best possible offer for my seller. When representing buyers, our job is to be creative in crafting an offer such that it will best align with the seller’s goals, timeline, and expectations.

2021’s strong seller’s market led to a 6% year-over-year increase in the median price of a floating home to $1,400,000. Likewise, the average Price per Sq.Ft. of floating homes sold in 2021 increased to $1,294/Sq.Ft., a 2% increase from 2020.

A new Price per Sq.Ft. record of $2,539/Sq.Ft. was set this year by 2822 Boyer Ave E #11, beating the two records set last year at $2,345/Sq.Ft. and $2,448/Sq.Ft. This picturesque A-frame cabin boasts 1,024 Sq.Ft., 2 bedrooms, and it moors at the end of the dock on Boyer On The Bay in Portage Bay. As a prime example of the strong appreciation we have been witnessing, this floating home had previously sold in 2017 for $1,734,000, and 2021’s sale price of $2,600,000 shows a 50% increase in value in just 4 years, or 10.7% year-over-year appreciation.

Contact us to find out what your floating home is worth and how to strategically price it in this unprecedented market.

The Ever-Changing Buyer Profiles

The pandemic changed real estate markets worldwide and our floating home market was no exception. The change in buyer’s needs as a result of the pandemic changed the makeup of our typical floating home buyer.

Buyers hailing from tech-driven fields in Seattle such as life sciences, engineering, technology, and telecommunication are shaping our local real estate market. The pandemic-fueled remote-work lifestyle shift coupled with liquidating stock has motivated many tech buyers in the Seattle area to seek out primary and secondary homes with outdoor access such as floating homes which provide stellar access to water activities such as sailing and paddleboarding to name just a few. For this reason, our floating home listings appear on publications popular with tech workers such as GeekWire.

Pandemic-induced isolation has also motivated many buyers to seek out homes in tight-knit communities. Known for its strong sense of community and identity, floating homes have attracted community-driven buyers more than in previous years. Many look forward to meeting and establishing lasting relationships with their new dock mates and being active participants on HOA boards.

An increasing share of our floating home buyers in 2021 were Millennials. They are entering the home-buying market en masse as they reach new life milestones, with 4.8 million millennials turning 30 in 2021. Millennials care deeply about home offices which has changed the way we stage and market floating homes. We have also found that our Millennial buyers are increasingly choosing to buy floating homes because they wish to reside in more established communities in neighborhoods that promote new urbanism with proximity to restaurants, shopping, and grocery stores. One of the ways we are advertising our floating home listings to Millennials is through social media with tools such as Social Ad Engine – a custom tool Sotheby’s created in partnership with Facebook that identifies the most likely buyers of floating homes based on browser cookies they leave on real estate websites like Zillow.

Local CEOs and C-Level executives continue to fuel the craze for luxury floating homes to use as either a primary residence or a secondary home, particularly those homes with excellent water views. Our floating homes are aggressively advertised in publications as The Puget Sound Business Journal which are widely read by local CEOs and C-Level executives.

A small but significant portion of floating homes buyers in 2021 and 2020 came from within the floating home community. Some of our floating home clients either upgraded to larger floating homes with more bedrooms, while others downsized to smaller floating homes with perhaps a better view or parking.

While these are some of the most common buyer profiles, every floating home is unique and so it will attract a unique buyer. In our initial meeting with prospective sellers, we identify who is the best and most likely buyer for their floating home so that we can customize our marketing message and choose the most appropriate advertising placements for their home.

Space Comes at a Premium

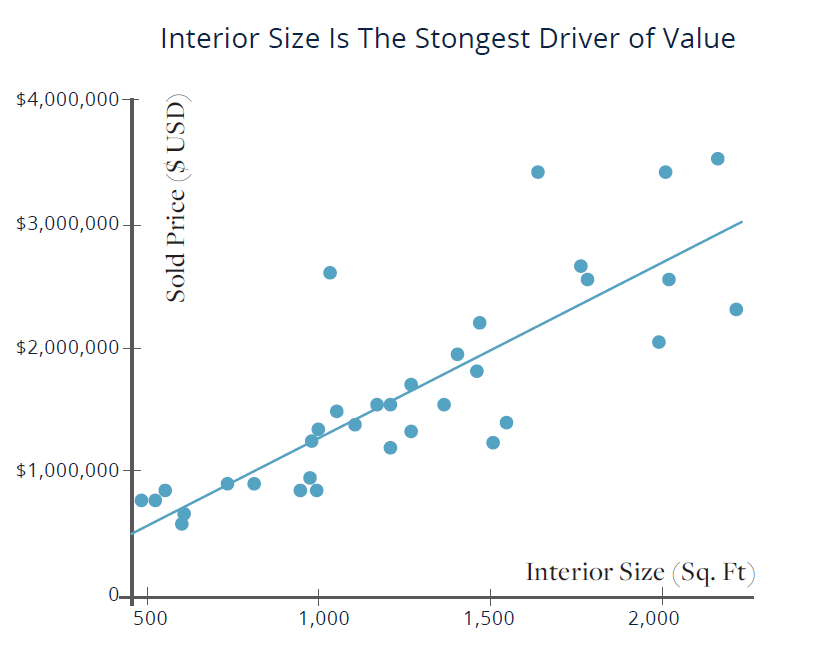

The interior size of a floating home (measured in square feet) remains the largest driver of value. One of the most useful metrics we use in pricing a floating home is the Price Per Square Foot (Price/Sq.Ft.) metric. Contrary to popular belief, the Price/Sq.Ft. metric is a more useful metric for determining the prices of floating homes than homes on land. Land homes can vary greatly in one aspect that makes the Price/Sq.Ft. metric less useful: lot size. That is to say that a 2,000 Sq.Ft. home on 100 acres, would be worth significantly more than a comparable 2,000 Sq.Ft. on a tiny lot. Floating homes, on the other hand, have rather insignificant variations in lot sizes which makes the Price/Sq.Ft. metric very useful to compare floating homes.

The graph above plots the price of floating homes sold for in 2021 against their interior size showing a very strong and statistically significant correlation between the two variables. In fact, interior size alone can account for as much as 71% of the value of a floating home.

Contrary to popular belief, bedroom count is not a driver of value on its own. Floating homes with more bedrooms do sell for more than those with fewer bedrooms, but only because they are larger. This effect disappears once interior size (i.e., Sq.Ft.) is accounted for.

Another counterintuitive finding is that floating homes with more bedrooms do not necessarily sell faster than homes with fewer bedrooms. Our analysis of 2021 sales revealed that 2-bedroom floating homes sold the fastest (median of 7 days on the market) compared to 1-bedroom and 3-bedroom floating homes which sold in 13 days and 15 days, respectively.

While interior size is the strongest driver of value, it should never be used on its own as it does not capture the many qualities buyers seek in a floating home. In the next few sections, we discuss some of the other features that most influenced floating home prices in 2021.

Condition

Supply chain issues and labor shortages have and will continue to make it difficult for buyers to remodel floating homes in a timely and cost-effective fashion. Not surprisingly, buyers in 2021 paid a premium for move-in-ready floating homes in excellent shape.

In fact, the floating homes our raters believed to be in “Excellent Condition” sold for 49% more (on average) than homes rated as being in “Good Condition”. Likewise, floating homes in “Good Condition” sold for 31% more than homes in “Fair/Poor Condition”.

A Price/Sq.Ft. analysis (which accounts for interior size) paints a similar picture: homes in “Excellent Condition” sold for 20% more (on average) than homes in “Good Condition” and homes in “Good Condition” sold for 19% more than homes in “Fair/Poor Condition”.

While floating homes are selling quickly, physical condition can increase or decrease time on the market. For example, in 2021, floating homes in “Excellent Condition” sold in just 7 days (median) compared to 17 days for homes in “Fair/Poor Condition”.

Prospective sellers of floating homes needing improvements or a cosmetic remodel may realize a strong return on investment in 2022 by completing such home improvements projects before listing their home for sale if their timeline and budget allows. Our team can help you maximize your return on investment by guiding you through the improvements we are seeing buyers appreciate and pay the most for. Our sellers are often surprised how small changes can make a big difference in how buyers perceive the condition and appeal of the home. Our team can also help you project manage those improvements and source the appropiate contractors.

A floating home’s neighborhood has always proven a reliable driver of value. As found in previous years’ reports, floating homes on Eastlake continued to enjoy a premium sales price. In 2021, Eastlake floating homes sold, on average, for $1,833,429, compared to $1,686,875 for Westlake floating homes and $1,344,962 for Portage Bay floating homes.

Westlake averaged higher sale prices than Portage Bay in 2021 ($1,686,875 vs. $1,344,962) although this can be explained by size. Floating homes offered for sale on Westlake in 2021 were significantly larger than in Portage Bay thus commanding a higher sales price. A Price/Sq.Ft. analysis reveals that when size is accounted for, floating homes in Portage Bay actually sold for 8% more than homes on Westlake ($1331/Sq.Ft. vs $1238/Sq.Ft.), which is in line with our findings from previous years.

Our listing at Lee’s Mooring dock in Fremont (933 N Northlake #1) was the only floating home sold in Fremont in 2021, thus no comparative analysis is provided for this neighborhood.

Our intimate knowledge of each of our four neighborhoods has helped us identify the common buyer profiles each attracts. This knowledge has proven to be crucial when representing sellers. Not only does it help us to more accurately price our listings, but it also aids us in crafting effective marketing messages that resonate with buyers. When representing buyers, we are careful to listen to their needs and motivations so we may advise them on which neighborhoods best align with their dream to live on a floating home.

Location, Location, Location

Seattle Map of the four neighborhoods with houseboats (floating homes) Westlake, Fremont, Eastlake, and Portage Bay

With approximately 200 miles of shoreline, opportunities to live on the waterfront abound in and around Seattle. But there’s waterfront living, and then there’s living on the water on Lake Union. While all four neighborhoods (i.e., Eastlake, Portage Bay, Westlake, Fremont) provide exceptional opportunities to enjoy life on the lake, each is unique in its offering.

Eastlake, where our largest concentration of floating homes moor, is quite appealing to buyers for its neighborhood feel, proximity to amenities, afternoon sun and iconic views of downtown Seattle and the Space Needle.

Westlake, where Tom Hanks popularized floating home living, is appealing to buyers for its action-packed views of Lake Union, ease of parking, proximity to downtown Seattle & Fremont, and morning sun.

Portage Bay, where our second largest concentration of floating homes moor, is popular with buyers seeking morning sun, more tranquil and private waters, calmer pace of life, and quicker access to Lake Washington by boat.

Host to only a very small number of floating homes, Fremont is popular with buyers seeking walkability to everything downtown Fremont has to offer, UW, and Gasworks Park.

The Value of a View

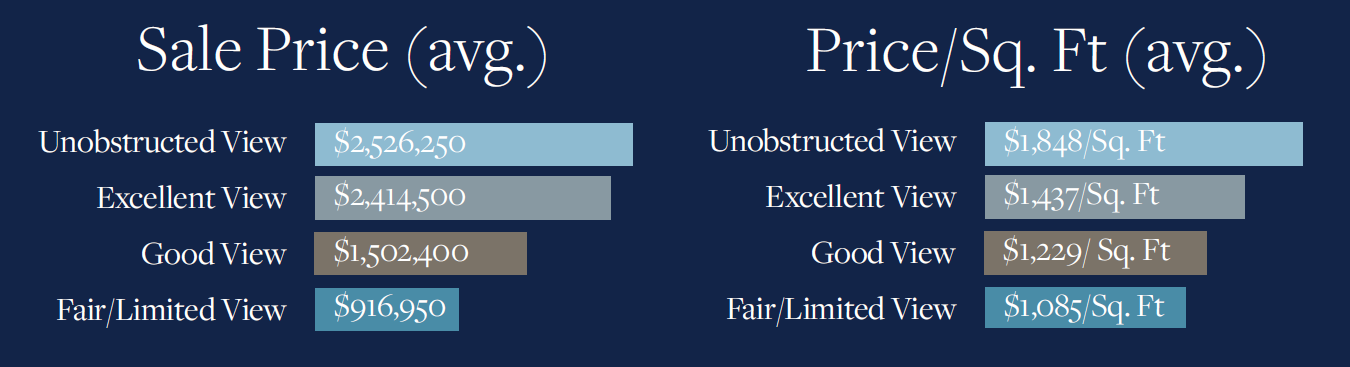

Seattle’s beautiful scenery is incomplete without our water views, which is one of the main draws to floating home living. Thus, it is no surprise that floating homes with a better view sell for a premium. In fact, when our independent raters judged the quality of the view of all floating homes sold in 2021, our analysis of the data revealed that floating homes with an “Unobstructed View” sold for an average of $2,526,250, compared to $916,950 for floating homes with “Fair/Limited Views”.

Accounting for interior size, a Price/Sq.Ft. analysis confirms this trend: Floating homes with an “Unobstructed View” sold for an average of $1,848/Sq.Ft., compared to $1,085/Sq.Ft. for floating homes with a ”Fair/Limited View”, a 70% difference in value.

Moreover, as previously mentioned, most floating homes sold quite quickly in 2021 compared to previous years, but floating homes with a better view sold even quicker. This is particularly true for those with “Unobstructed Views” such as the highly-priced end-of-dock floating homes. For instance, in 2021, floating homes with “Unobstructed Views” sold in just 8 days (median), compared to 33 days for floating homes with “Excellent Views”.

2022 Outlook

Short of a major change in the trajectory of the pandemic or other unforeseen events, the floating home market is poised for another year of growth in 2022. Early conversations with our prospective buyers and sellers indicate strong demand for floating homes amidst record-low inventory which will likely manifest itself in another year of bidding wars and systemic appreciation.

Pre-pandemic, it was advisable to wait until Spring or Summer to list a floating home. With today’s strong buyer demand and limited inventory, floating homes can sell with great success anytime of the year. Prospective sellers can particularly benefit from listing in the Winter (January, February, March) due to months of pent-up buyer demand with virtually no floating homes listed for sale.

If you are considering selling your floating home this year, we welcome the opportunity to meet with you and collaboratively craft a custom listing plan and marketing package that leverages the power of Sotheby’s International Realty – the most trusted and largest luxury real estate firm worldwide.

2021 Floating Homes Sales in Seattle

Call today if you’re considering a move, it’s an important call to make

Realogics Sotheby’s International Realty (RSIR) brokers bring 30+ years of experience representing more than 100 clients who purchased and sold houseboats in Seattle.

As the largest luxury real estate brand worldwide, Sotheby’s International Realty brokers can market floating homes locally and globally, with an unrivaled presentation that has earned the brand over 130 marketing and sales awards.

Leave a Reply

You must be logged in to post a comment.